If you are a travel lover who frequently travels to different places and is looking for the best travel credit card in India, the American Express Platinum Travel Credit Card is like your traveling partner. Without your partner, you do not feel good while traveling, and without the Amex Platinum Travel Credit Card, your journey looks incomplete.

The attractive rewards, exclusive offers, and impressive travel perks make your travel or journey more interesting. This card is ideal for anyone looking to elevate their travel experience with an incredible reward rate that’s held strong over the years, it’s often called India’s “best travel credit card.” Here’s an in-depth review of the Amex Platinum Travel Credit Card, covering all benefits, fees, and features that make it an ideal travel companion.

Overview of American Express Platinum Travel Credit Card

The American Express Platinum Travel Credit Card is one of the most popular choices for travelers in India. Known for its incredible rewards, it offers value, travel benefits, and flexibility. Designed for frequent flyers and travel enthusiasts, this card makes every transaction worth spending.

Notably, it has won the title of “best travel credit card in India” for several years in a row. This review dives into why the Amex Platinum Travel Card deserves its reputation.

Why Choose the American Express Platinum Travel Credit Card?

American Express is known for providing top-notch services and premium benefits to its cardholders. The Platinum Travel Credit Card is no different, designed to meet the needs of those who want an exclusive experience while traveling. This card offers rewards that can translate into significant travel savings, plus perks that add extra comfort and convenience to your journey.

Key Benefits of the American Express Platinum Travel Credit Card

American Express Platinum Travel Credit Card has hundreds of benefits for their cardholders, here are few main benefits are explained:

- Welcome Gift: Upon signing up for the American Express Platinum Travel Credit Card, you’re welcomed with 10,000 Membership Rewards Points. These points can be redeemed for exciting travel-related offers or even statement credits, giving you a solid head start on rewards.

- Travel Vouchers: The card shines for its travel benefits, primarily through its Milestone Program. You can earn travel vouchers worth INR 7,700 on spending INR 1.9 lakhs in a year. If you spend INR 4 lakhs annually, you get vouchers worth a total of INR 11,800.

- Airport Lounge Access: With this card, you get complimentary access to domestic airport lounges across various major cities in India. This benefit can be extremely valuable for frequent travelers who value comfort and convenience at airports.

- Reward Points on Every Spend: Earn 1 Membership Rewards point per INR 50 spent on your card for eligible purchases and up to 10x points on select partner brands. Points can be redeemed for exclusive offers, travel vouchers, or even statement credits.

- Travel Benefits and Discounts: Through partnerships with airlines, hotels, and travel websites, American Express provides various travel-related offers that can save you on bookings and hotel stays.

- Exclusive Dining Offers: As an Amex Platinum Travel cardholder, you can enjoy exclusive dining privileges at select premium restaurants. American Express often offers discounts and other benefits, making this card valuable for food lovers.

Eligibility Criteria for American Express Platinum Travel Credit Card

Before applying, ensure you meet the following eligibility requirements:

- Age: The primary cardholder must be at least 18 years old.

- Income: The applicant should have a stable income and meet the bank’s specific criteria.

- Credit Score: A good credit score is essential to qualify for this card.

Fee Structure for the Amex Platinum Travel Credit Card

It’s essential to consider the fees associated with the card to understand if the rewards outweigh the cost:

- Joining Fee: INR 3,500 + GST, which is generally a reasonable amount given the benefits.

- Annual Fee: INR 5,000 + GST, waived off if certain annual spending milestones are met.

How to Maximize Rewards and Benefits With This Card

To make the most of your American Express Platinum Travel Credit Card, follow these tips:

Spend to Earn Travel Vouchers

If you’re a frequent traveler, aim to hit the spending milestones of INR 1.9 lakhs and INR 4 lakhs annually. By doing so, you’ll receive valuable travel vouchers that more than compensate for the card’s annual fee.

Use Points Wisely

Your Membership Rewards Points can be redeemed for travel vouchers or transferred to partner airlines, giving you flexibility. Plan your redemptions around high-value opportunities, such as airline ticket redemptions, to maximize value.

Utilize Airport Lounge Access

Take advantage of complimentary lounge access at domestic airports. Lounges offer a more comfortable waiting experience with amenities like Wi-Fi, food, beverages, and relaxation areas, making this a valuable perk.

Comparing the American Express Platinum Travel Credit Card with Other Travel Cards

When comparing travel credit cards, it’s essential to look at their unique benefits and see how they stack up:

| Feature | American Express® Platinum Travel | HDFC Regalia | SBI Elite Card |

|---|---|---|---|

| Welcome Points | 10,000 MR Points | 2,500 Reward Points | 5,000 Reward Points |

| Lounge Access | Domestic Lounges | Domestic & International Lounges | Domestic Lounges |

| Travel Vouchers | INR 7,700 and INR 11,800 | NA | 1,000 Points |

| Annual Fee | INR 5,000 | INR 2,500 | INR 4,999 |

The Amex Platinum Travel Card outshines most competitors in terms of travel vouchers and Membership Rewards Points, particularly if you frequently travel within India.

How to Apply for the American Express Platinum Travel Credit Card

To apply, follow these simple steps:

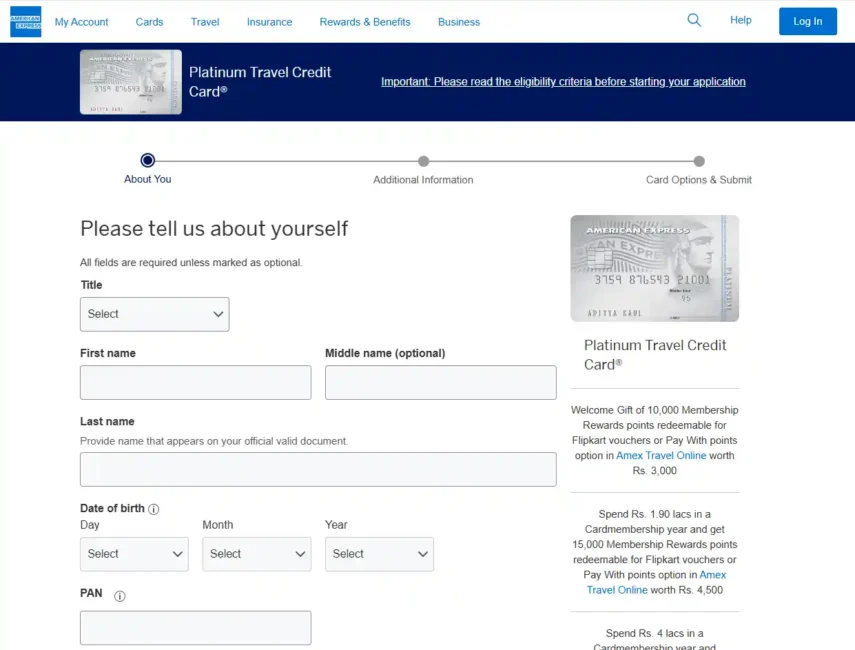

- Visit the American Express Website: Go to the official website to apply directly and review any updated offers.

- Find the “Apply Now” button and click it.

- Fill Out the Application Form: Provide your personal details, including income and employment information.

- Submit Required Documents: Submit identity proof, address proof, and income proof as required by American Express.

- Wait for Approval: The approval process is typically quick, and once approved, your card will be dispatched promptly.

Alternatively, you can visit your nearest American Express branch if you prefer an in-person application process.

How to Do American Express Platinum Travel Credit Card Login

Logging in to your American Express account is quick and straightforward, enabling you to manage your card, check statements, view transactions, and more. Here are the steps:

Step-by-Step Login Guide:

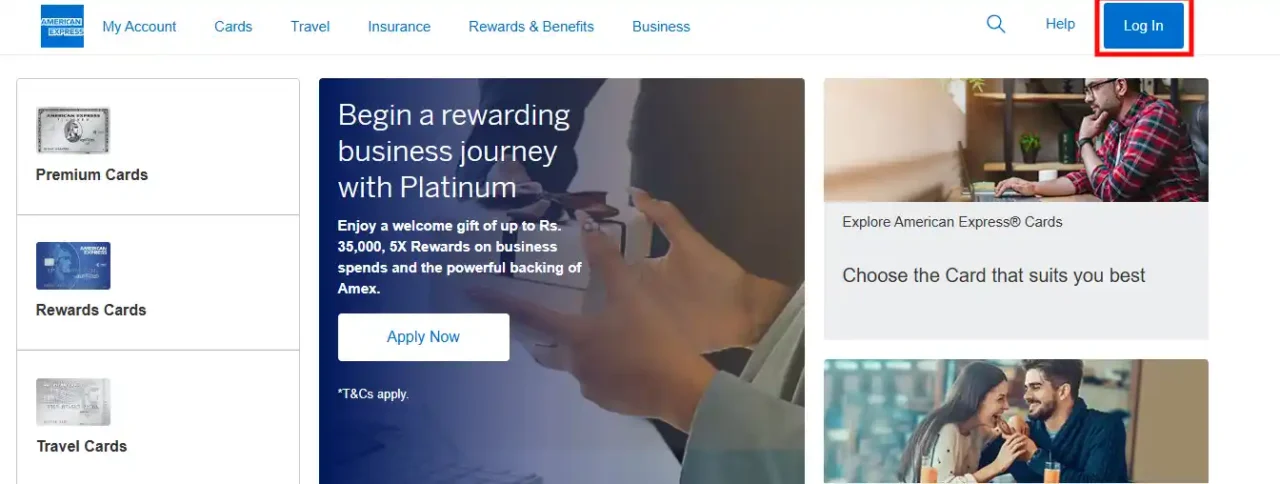

- Visit the Official Website: Open your browser and go to the American Express India website.

- Click on ‘Log In’: At the top right corner, click on the “Log In” button.

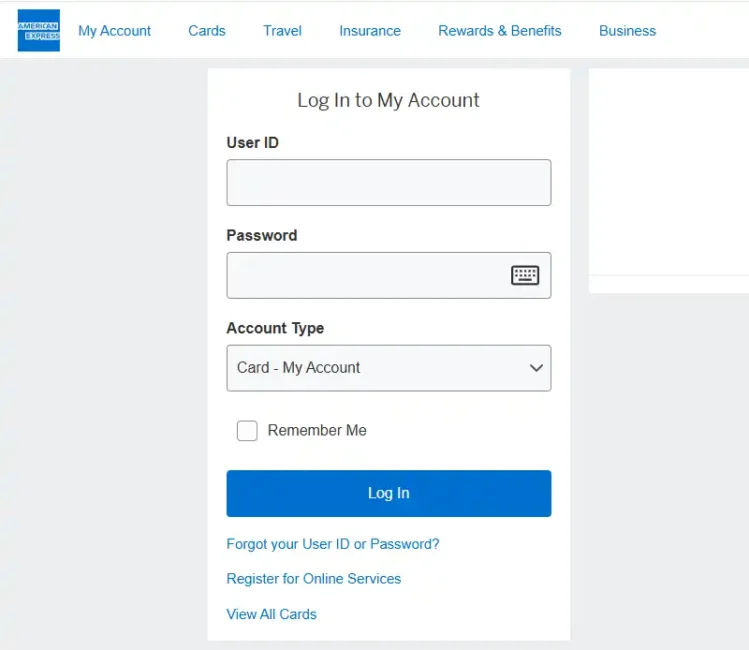

- Enter Your Credentials: You’ll be prompted to enter your User ID and Password. If you’re a first-time user, click on “Create New Online Account” and follow the instructions to set up your login credentials.

- Access Your Account: After entering your credentials, click on “Log In.” You should now be able to view your account dashboard and manage your American Express Platinum Travel Credit Card.

How to Check American Express Platinum Travel Credit Card Balance

There are several ways to check your credit card balance, including online, through the app, and via customer service.

Ways to Check Balance:

- Using the Amex Online Account:

- Log In to your American Express online account as explained above.

- Go to the “Accounts” section.

- Your current balance, available credit, and recent transactions will be displayed on the dashboard.

- Amex Mobile App:

- Open the Amex Mobile App and log in with your User ID and Password.

- Tap on your Platinum Travel Credit Card account to see your current balance, recent activity, and available credit.

- Checking via Customer Support:

- You can also check your balance by calling the American Express customer service helpline.

- Follow the prompts or speak with a representative to inquire about your current balance.

- SMS Alerts (if available): If you’ve registered for SMS alerts, you may receive regular balance updates or request balance information by sending a specific SMS code to the Amex service number.

How to Activate American Express Platinum Travel Credit Card

Once you receive your new card, it needs to be activated before you can use it. Activation is quick and can be done online or via phone.

Steps to Activate Your Card:

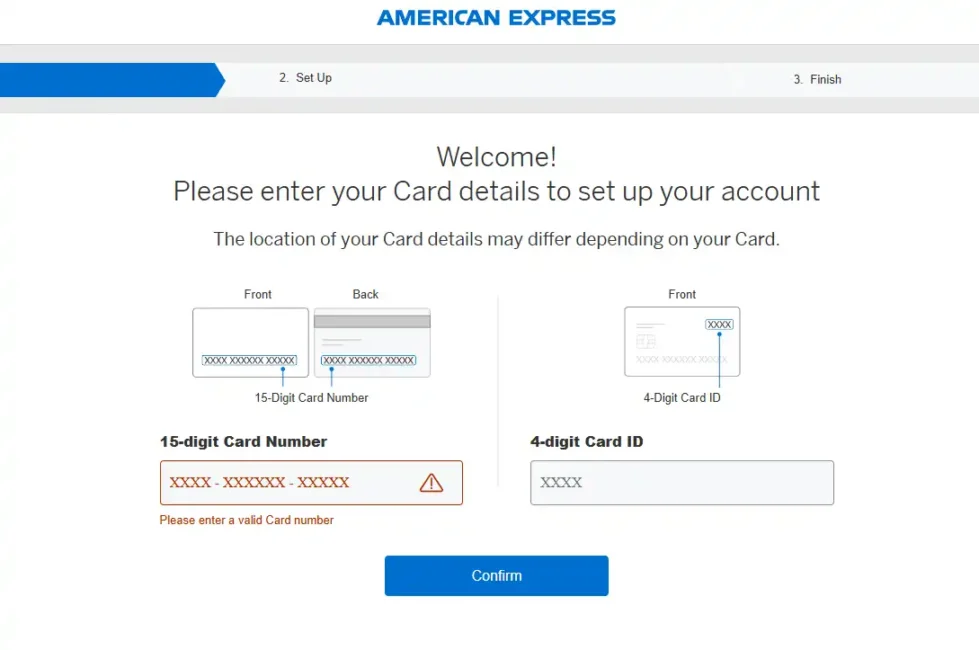

- Activation via Online Account:

- Visit the American Express official website.

- Find & Select the “Activate My Card” in the Menu option.

- Follow the prompts, enter the necessary information (such as the card number and any required personal details), and complete the activation process.

- Activation through the Amex Mobile App:

- Open the Amex Mobile App and log in to your account.

- In the menu, find the “Activate Card” option.

- Enter your card details as prompted, confirm your information, and your card will be activated.

- Activation by Phone:

- Call the American Express activation hotline. This number will typically be provided in the mailer you receive with your card.

- Follow the voice prompts to enter your card details and personal information.

- Once confirmed, your card will be ready for use.

Customer Service and Support

American Express is renowned for its excellent customer support. With this card, you’ll receive 24/7 customer service and access to the American Express online portal, which makes managing your account and transactions easy.

Emergency Support and Card Replacement

One major benefit of holding an American Express card is the emergency support system. Whether you’ve lost your card abroad or need assistance with an unexpected issue, Amex is always available to assist you.

Pros and Cons of the American Express Platinum Travel Credit Card

Pros

- High-Value Travel Vouchers: Ideal for frequent travelers who can meet the annual spending milestones.

- Excellent Rewards Rate: Generous points on purchases that can be redeemed for travel and other exclusive deals.

- Complimentary Lounge Access: Enhances travel experience with access to domestic airport lounges.

- Exclusive Dining Privileges: Offers and discounts at select restaurants.

Cons

- High Annual Fee: The annual fee of INR 5,000 may be on the higher side for some users.

- Limited Lounge Access: Access is restricted to domestic lounges only, which may not suit international travelers.

- Requires High Spending: The full benefit of the card is achieved only if annual spending milestones are met.

Is the American Express Platinum Travel Credit Card Right for You?

This card is ideal for frequent domestic travelers who value rewards and lounge access. If you frequently fly within India and can meet the annual spending thresholds, the travel vouchers alone can offset the annual fee. Moreover, the exclusive dining and rewards points accumulation add significant value to your spending.

However, if your travel is primarily international, you may want to consider a card with a broader lounge access network or international travel benefits.

FAQs

What is the American Express Platinum Travel Credit Card?

The American Express Platinum Travel Credit Card is a premium travel card offering exclusive travel-related benefits, such as reward points, travel vouchers, and airport lounge access. It’s designed for frequent travelers looking to make the most of their spending through valuable rewards and exclusive perks.

What are the key benefits of the American Express Platinum Travel Credit Card?

The card offers a variety of benefits including a welcome bonus of 10,000 Membership Rewards points, travel vouchers worth up to INR 11,800 on meeting annual spending milestones, complimentary domestic lounge access, and exclusive dining and lifestyle offers.

How can I earn travel vouchers with the American Express Platinum Travel Credit Card?

You can earn travel vouchers by reaching annual spending milestones:

Spend INR 1.9 lakhs in a year to earn travel vouchers worth INR 7,700.

Spend INR 4 lakhs in a year to earn additional vouchers, bringing the total to INR 11,800.

Is there a welcome bonus for new American Express Platinum Travel Credit Card cardholders?

Yes, new cardholders receive 10,000 Membership Rewards points as a welcome gift upon joining, which can be redeemed for travel, shopping, or as a statement credit.

Does the American Express Platinum Travel Credit Card offer airport lounge access?

Yes, the card provides complimentary domestic lounge access at select airports in India. This benefit enhances the travel experience by providing a comfortable waiting area with amenities such as Wi-Fi, refreshments, and relaxation areas.

What is the annual fee for the American Express Platinum Travel Credit Card?

The annual fee for the card is INR 5,000 + GST. There is also a one-time joining fee of INR 3,500 + GST. These fees are offset by the value of travel vouchers and reward points if spending milestones are met.

What are Membership Rewards points, and how can they be redeemed?

Membership Rewards points are loyalty points that can be earned through purchases. They can be redeemed for travel vouchers, statement credits, or transferred to airline partners. Points accumulation can help you save on travel and enhance your overall experience.

Conclusion

The American Express Platinum Travel Credit Card is a solid choice for anyone looking to enhance their domestic travel experience while reaping substantial rewards. While the card does come with a relatively high annual fee, the benefits it offers—especially in terms of travel vouchers and airport lounge access—can provide an exceptional value proposition for the right cardholder.

For those who frequently travel, enjoy premium experiences, and appreciate exclusive perks, this card is worth considering. The rewards structure and milestone benefits align well with the needs of travelers looking to maximize their experiences.

You can also read: