The Cerulean Credit Card is a financial tool designed to help individuals build or rebuild their credit. Backed by Continental Finance, the card caters to those with poor or limited credit history, offering the chance to improve credit scores while providing the necessary purchasing power. With its straightforward application process and user-friendly features, this card has gained popularity among credit management beginners.

Whether you’re interested in learning how to do Cerulean credit card Login, make a payment, or access customer service, this guide provides everything you need. Let’s learn in detail about all the aspects of the Cerulean credit card and its features.

What is the Cerulean Credit Card?

The Cerulean credit card, issued by the Bank of Missouri and managed by Continental Finance, is primarily geared to people with limited or damaged credit history. Its primary goal is to help users build or rebuild their credit score while giving them access to an unsecured credit line. With regular usage and timely payments, this card can be a step towards financial freedom.

Key Features and Benefits

- Credit Building Opportunities: Reports to all three major credit bureaus (Experian, Equifax, and TransUnion).

- Ease of Use: Online account management and a mobile app.

- Accessible Application Process: Requires minimal credit history, making it ideal for individuals with poor credit.

- Fraud Protection: Offers robust security measures to protect users against unauthorized transactions.

Eligibility Criteria

- Must be at least 18 years old.

- Have a valid Social Security number.

- Provide proof of income to ensure repayment ability.

- Meet the issuer’s minimum credit score requirements.

How to Access & Manage the Cerulean Credit Card Account

Accessing your Cerulean credit card account online is simple. The Cerulean credit card login portal allows users to manage their accounts, track spending, view details, and make payments.

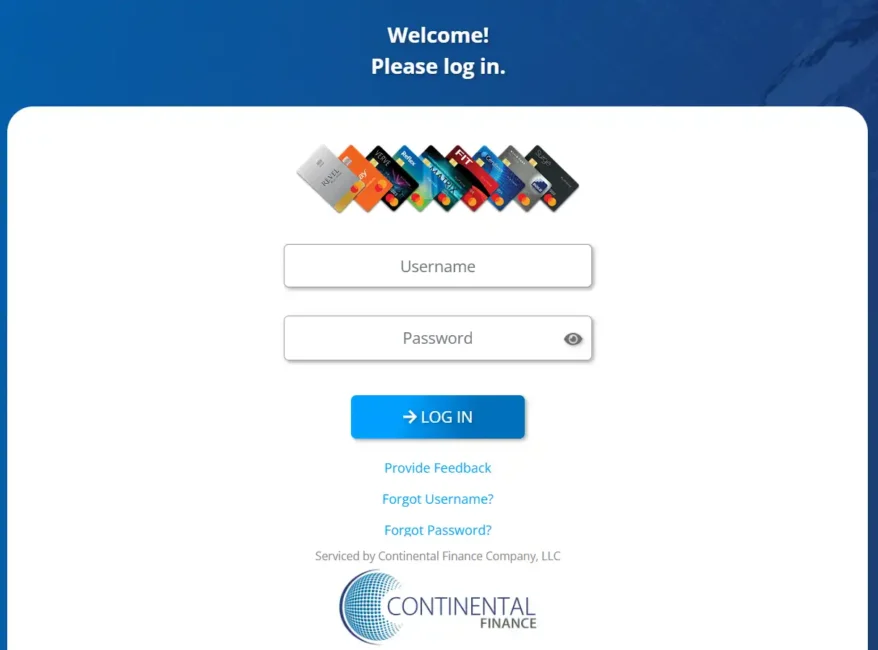

Cerulean Credit Card Login Step-by-step Process

- Visit the Cerulean Credit Card Official Website.

- Find & click the “Login” option in the Menu.

- The Login Page open in your browser.

- Enter the login Credentials, such as Username & Password.

- Once you’ve entered the details, click the “Login” button to access your account dashboard.

How to register your Cerulean Credit Card for Online Account Access

If you receive your Credit Card after the application process and want to manage your credit card online, then you have to register your Cerulean Credit Card for Online Account Access. The Registration process is as follows:

- Visit the Cerulean Credit Card Login Page.

- Find and click the “Register for Access” option.

- Now, you have to enter some details to register your Cerulean Credit Card, such as:

- Last 4 Digits of Card Number.

- Last 4 Digits of SSN/ITIN.

- Your Billing ZIP address.

- After entering all the details, click the “Next” button.

- Here, you have to enter some personal details and communication details.

- Now, you have to create login credentials such as username and password, which helps you to login to the Cerulean credit card website to manage your credit card.

- That’s it, your registration process is completed.

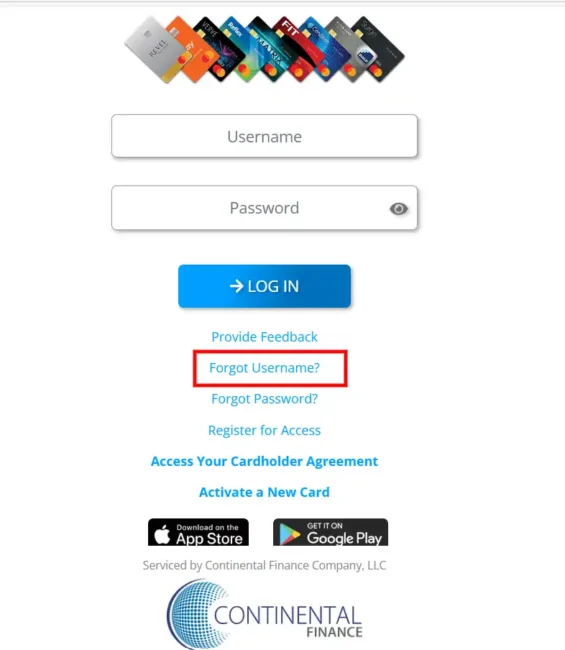

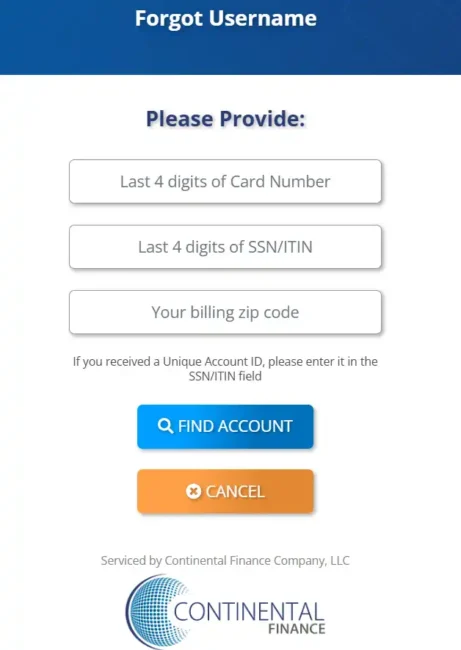

What to do if forget the Username

Here is the step-by-step process to retrieve the cerulean credit card username: –

- Visit the Cerulean Credit Card Login Page.

- Find and click the “Forget Username” option.

- Enter some useful information to retrieve the username, such as: –

- Last 4 Digits of Card Number.

- Last 4 Digits of SSN/ITIN.

- Your Billing ZIP address.

- After entering all the details, click the “Find Account” button.

- Now, Your Username is displayed on your Screen or sent by mail to your registered email address.

How to Reset Your Credit Card Account Password

If you forget your cerulean credit card account password, then you can follow the Below’s step-by-step instructions to resetting your account password: –

- Visit the Cerulean Credit Card Login Page.

- Find and click the “Forget Password” option.

- Enter your Credit card account Username.

- Click the “Find Account” button.

- Follow the instructions sent to your email to reset your password.

How to Activate your Cerulean Credit Card

After receiving your New Cerulean Credit Card, you have to activate your credit card using the Cerulean official website, here is the step-by-step process to activate your card: –

- Go to the Cerulean Credit Card Login Page on their official website.

- Find & click “Activate a New Card” option.

- After this, you have to enter some details to activate your credit card, such as: –

- Last 4 Digits of your credit card number.

- Last 4 Digits of your SSN/ITIN.

- Your Billing Zip Code.

- After entering all the information, click the “Activate my Card” button.

- Now, Your Credit card has been activated.

How to check your Cerulean Mastercard Balance

- Through Login: You can login to your Cerulean Credit Card account online to check the remaining balance and track the transaction history.

- Mobile App: Use the Continental Finance app to check your credit card balance and transaction history.

- In-Store: You can also visit the store to checking the account balance.

Cerulean Credit Card Payment Options

Making timely payment is important for the credit card holders maintaining a good credit history. The Cerulean Credit Card offers multiple convenient payment methods.

1. Online Payments

Log in to your account and navigate to the payment section. You can link your bank account to make a direct payment.

2. Payment by Mail

Send a check or money order to the address listed on your billing statement. Ensure you include your account number on the payment for accurate processing.

3. Automatic Payments

Set up automatic payments to ensure you never miss a due date. This option can be activated from your online account dashboard.

4. Payment by Phone

Call the customer service number printed on the back of your card. Follow the prompts to make a payment securely.

How to Contact Cerulean Credit Card Customer Service

Efficient customer support is important for resolving issues quickly. The Cerulean Credit Card customer service team is readily available to assist users.

Contact Information

- Phone Support: Call 1-866-449-4514 for account-related inquiries.

- Email Support: Use the secure messaging option in your online account.

- Mailing Address: For written correspondence, refer to the address on your statement.

Common Issues Handled

- Billing discrepancies

- Card activation or replacement

- Payment disputes

- General inquiries about account features

Honest Review of the Cerulean Credit Card

The Cerulean Credit Card is a valuable option for credit-building purposes, especially for individuals with less-than-perfect credit. Here’s an honest evaluation:

Pros

- Ease of Approval: Ideal for those rebuilding credit.

- Reports to Credit Bureaus: Helps improve your credit score over time.

- Unsecured Credit Line: No collateral required.

Cons

- High Fees: Annual and potential late fees can add up.

- Limited Rewards: Unlike some cards, this one doesn’t offer cashback or travel perks.

- High APR: May not be suitable for carrying a balance.

Expert Analysis

The card is ideal for credit-building purposes but falls short in terms of rewards and low-cost options.

User Experiences

Most users appreciate the straightforward application process and credit-building features. However, some criticize the high fees and interest rates.

Is It Worth It?

If rebuilding credit is your primary goal, the Cerulean Credit Card is a reliable option. For those seeking rewards and perks, other alternatives may be more suitable.

Alternatives to the Cerulean Credit Card

- Capital One Platinum Credit Card

- Discover it Secured Credit Card

- American Express Platinum Credit Card

Who Should Consider the Cerulean Credit Card?

This card is best suited for individuals seeking a steppingstone to better financial health. If used responsibly, it can pave the way for access to premium credit options in the future.

Tips for Maximizing Your Cerulean Credit Card

- Pay in Full Monthly: Avoid interest charges by paying your balance in full each month.

- Monitor Your Credit Score: Use the free credit score feature to track improvements.

- Avoid Late Payments: Set reminders or automate payments to avoid late fees.

- Use Responsibly: Keep your credit utilization low to improve your credit score.

FAQs

What is the Cerulean Credit Card?

The Cerulean Credit Card is a credit-building card for individuals with poor or limited credit histories.

How do I pay my Cerulean Credit Card bill?

Payments can be made online, via the mobile app, by phone, or by mail.

Is the Cerulean Credit Card good for building credit?

Yes, it reports to major credit bureaus, making it a helpful tool for improving your credit score.

How can I contact customer service?

Customer service is available through phone, email, and chat. Call 1-866-449-4514 for account-related inquiries.

Can I manage my account through a mobile app?

Yes, the Cerulean mobile app offers comprehensive account management features.

Conclusion

The Cerulean Credit Card is a practical option for credit building, offering essential features and tools. While it has its drawbacks, such as high fees, its benefits make it a worthwhile choice for individuals committed to improving their financial health.