If you are working in UAE, are a Ratibi Prepaid Cardholder, and want to check your salary online, then you are at the right place. In this article, we will explain all the methods related to Ratibi Card Salary Check.

The Ratibi card has emerged as a popular solution for employees, especially in the UAE, who receive their salaries electronically without needing a traditional bank account. Whether you’re a new Ratibi card user or someone exploring the best ways to manage finances, this post will help you understand how to check your salary online and access card services in the UAE.

Through the Ratibi Card Balance Inquiry Service employees can easily check whether their salary is credited to their account or not. In this, Ratibi Card Salary Check guide, I will explain all the methods that you can you to check your Ratibi Prepaid Card Balance.

What is a Ratibi Card?

The Ratibi card is a payroll solution offered by several UAE-based banks, such as First Abu Dhabi Bank (FAB) and ADCB, for companies to distribute salaries electronically. This card is primarily aimed at low-wage workers who may not have access to regular bank accounts, providing a convenient way to access their salaries.

- Cardholders: Workers earning less than AED 5,000 per month.

- Purpose: Secure and cashless salary distribution.

- Features: No requirement for a personal bank account, easy access to salaries, and secure transactions through ATMs and POS terminals.

Companies prefer the Ratibi card as it complies with the Wage Protection System (WPS), ensuring transparent payroll management.

How Does Ratibi Card Work?

Employers use the Ratibi card to deposit employees’ salaries every month. Cardholders can withdraw cash from ATMs or use it at stores with POS terminals.

The card comes with an online portal or a mobile service to track salary credits and view balances. Most providers offer free SMS notifications for transactions and balance updates, ensuring users stay informed about their finances.

How to Check Salary Online Using Ratibi Card?

Checking your salary online through your Ratibi card is simple and convenient. Here’s a step-by-step guide for FAB Ratibi Card and other common providers:

#Method-1: Check Ratibi Card Salary using the Online Portal

- Visit the Official FAB Portal: Go to the First Abu Dhabi Bank Ratibi portal for Ratibi prepaid card balance inquiry.

- On this page, You have to enter the Last two digits of your Ratibi Card Number in the first box. The Ratibi Prepaid Card Number is a 16 16-digit card Number, You have to enter the Last 2 Digits of the Card Number.

- In the Second Box, You have to enter your Ratibi Card ID Number. The Ratibi Card ID is a 13-digit alphanumeric code mentioned below your card number.

- After entering all the details, Click the “Go” button.

- Now, the Available Balance in your Ratibi Prepaid Card is displayed on your screen.

By, following the above process you can check your Ratibi Prepaid Card Balance or Ratibi Card Salary Check.

You can follow the same above steps to check FAB Bank Balance Online.

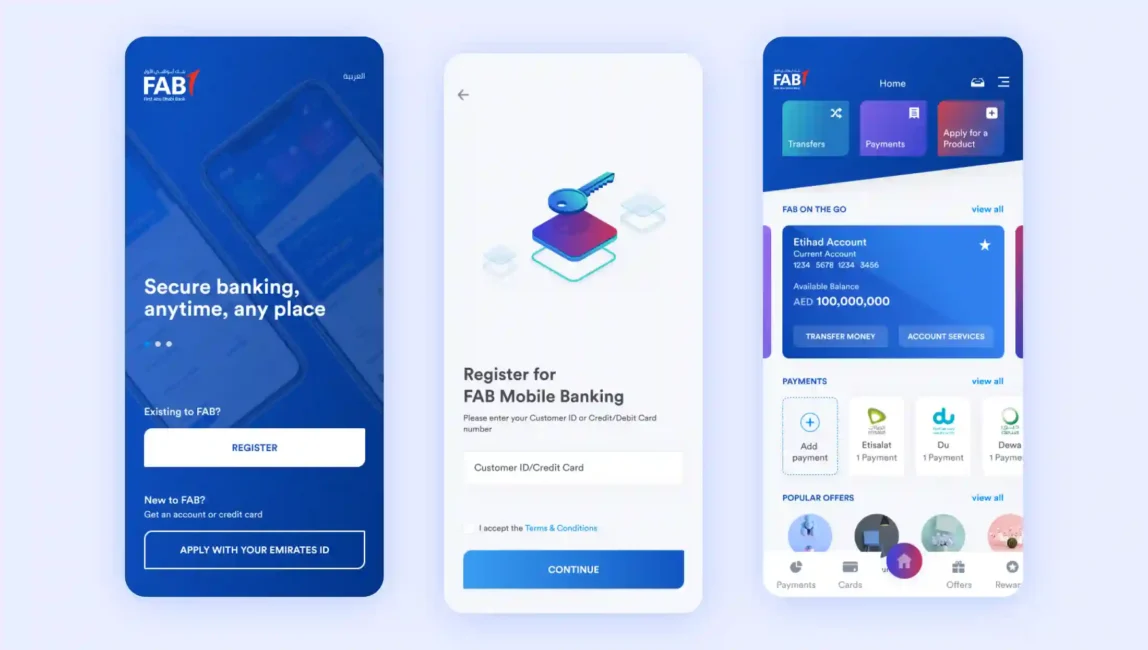

#Method-2: Ratibi Card Salary Check via FAB Mobile App

First Abu Dhabi Bank (FAB) has its own Mobile App to provide Mobile Banking services to its account holders and Ratibi Prepaid Card holders. You can use the FAB Mobile App to check your Ratibi Card Salary Online:

If you already have the FAB Mobile App on your Smartphone then you have to follow the below process to check the balance, If you do not have the FAB Mobile App on your Phone then you have to Download the FAB Mobile App for Android, iPhone/iPad.

- Open the FAB Bank Mobile App on your Smartphone.

- Click the “Already a Customer” option.

- You have to create an account first on the FAB App, and for that, you have to sign up with your Ratibi Card Number, Card ID, Emirates ID, and Some Personal details.

- After that, you have to create a Login passcode for further login.

- Now, you are successfully logged in to the FAB app.

- Here, You have to find and Select the Check Balance or View Balance option.

- Now, Select your Ratibi Card to check the Balance or Salary.

#Method-3: Ratibi Card Balance Check at FAB Bank ATM

Ratibi Card holders can check their Salary or Card Balance then you need to visit the nearby FAB Bank ATM. There are 290+ ATMs situated in different places in the United Arab Emirates. You have to find the ATM and visit there to check the Balance.

You can use the FAB ATM Locator Tool offered by FAB to find the nearest ATM

- Visit the nearest FAB ATM with your Ratibi Prepaid Card.

- Insert the Ratibi Card in the FAB ATM Machine.

- Choose the desired language option and enter your PIN Number.

- Select the Check Balance option or View Balance Option.

- Now, Ratibi Card Balance is displayed on your screen.

Other Ways to Check Your Salary and Transactions

In addition to online methods, here are other ways to track your salary:

- Bank Branches: If you experience issues with your card, visit the nearest branch of your bank for assistance.

- Customer Care: Call the bank’s hotline and follow the automated instructions to get your balance information.

How to Activate Your Ratibi Card?

Once your employer finishes your employment paperwork, you’ll get your Ratibi card. It comes with a package that has all the instructions you’ll need.

- Call Customer Service: Dial the bank’s helpline (e.g., FAB: +971 600 52 5500) and provide your card details to activate.

- Use Website or Mobile App: Log in with your card details, navigate to the activation section, and follow the instructions.

- Visit a Bank Branch: If needed, visit the nearest branch with your card and ID for activation assistance.

Once activated, you can access your salary, make withdrawals, and monitor transactions.

How do I know if my salary is credited to a Ratibi Card?

When your employer sends the salary, it goes straight to your Ratibi Card. FAB Ratibi Service sends you a free SMS alert each time you get paid.

But, if for some reason you don’t get the alert, you should check your balance online to see if the salary has been credited.

Benefits of Ratibi Card

The Ratibi card benefits both employers and employees by offering a secure, convenient, and compliant payroll solution.

For Employees

- Easy Salary Access: Salaries are deposited directly onto the card without delays.

- No Bank Account Required: Employees receive payments without the need to open a bank account.

- Convenient Withdrawals: Access cash through ATMs and make purchases at POS terminals.

- SMS Alerts: Get real-time notifications for salary deposits and transactions.

- Online Tracking: Monitor balance and salary history via online portals or mobile apps.

- No Monthly Fees: Most Ratibi cards are free of maintenance charges.

For Employers

- Wage Protection Compliance: Meets UAE’s Wage Protection System (WPS) requirements.

- Streamlined Payroll Process: Simplifies salary distribution for large workforces.

- Cost-Effective: Reduces administrative costs by eliminating manual payments.

- Enhanced Transparency: Ensures all salary payments are documented and traceable.

- Improves Employee Satisfaction: Ensures timely payments, boosting morale and retention.

How to Contact Ratibi Card Customer Service?

In case of queries or issues related to your Ratibi card, you can contact customer service for assistance. Below are the customer care details of popular Ratibi providers:

FAB Ratibi Card Customer Service:

- Phone: +971 600 52 5500

- Email: contactus@bankfab.com

ADCB Ratibi Card Customer Support:

- Phone: +971 600 50 2030

- Website: adcb.com

Ensure you have your card number and personal ID ready while contacting customer support for faster resolution.

FAQs

What is a Ratibi Card?

A Ratibi card is a payroll card used in the UAE to distribute salaries electronically, especially for workers who don’t have traditional bank accounts. It offers convenient access to salaries through ATMs, online portals, and mobile apps.

How Can I Check My Salary on the Ratibi Card?

You can check your salary via:

Online Portal: Log in to your bank’s Ratibi card portal.

Mobile App: Use your bank’s mobile app to view your balance and transactions.

SMS Alerts: Register your mobile number to receive salary notifications.

ATM: Insert your card and select “Balance Inquiry” to check your latest salary deposit.

Can I Check My Ratibi Card Salary Online Without Registering?

No, you need to register your card details on the bank’s online portal to access your salary and transaction history online. Some banks may allow quick balance checks through mobile apps without a complete registration.

What Should I Do If My Salary Doesn’t Reflect on My Ratibi Card?

If your salary is not credited:

Contact your employer to confirm the payroll status.

Check for SMS notifications or use an ATM to verify your balance.

If the issue persists, contact customer care at your bank to investigate further.

Can I Download My Salary Statement Online?

Yes, many Ratibi card providers allow users to download transaction statements through the online portal or mobile app. This statement can be used for personal records or visa applications.

What Happens If I Lose My Ratibi Card?

If your card is lost or stolen:

Report the loss to your bank’s customer care immediately.

The bank will block the card to prevent misuse.

Request a replacement card from the bank.

Is There a Mobile App to Check My Ratibi Card Balance?

Yes, many banks like First Abu Dhabi Bank (FAB) and ADCB offer mobile apps where users can log in with their Ratibi card details to check balances, salary deposits, and transactions.

How do I activate my Fab Ratibi salary card?

To activate your FAB Ratibi salary card, follow the instructions provided with the card. Usually, you will need to either call the designated customer service number or visit the bank’s official website to complete the activation process.

Conclusion

The Ratibi card offers a simple, secure, and efficient way to receive salaries without needing a bank account. For users, checking salary online is as easy as logging into the bank’s portal, using SMS alerts, or accessing the mobile app.

This payroll solution is ideal for employees in the UAE, ensuring transparency and ease of use while maintaining compliance with government regulations. If you are facing any issues, follow the troubleshooting tips above or contact the customer care team for help.

By staying informed and proactive, you can make the most of your Ratibi card and efficiently manage your salary.

Related Posts: